Best practices for mitigating call transfer risk

In our first article dedicated to call transfer strategies, we discussed how call transfers can be an efficient way to allocate resources, only connect with interested leads, and improve ROI. As a refresher, a call transfer occurs when a call center or lead generator connects a consumer directly to another party, often a buyer or advertiser, during a live phone call. Transfers are typically classified as:

- Warm transfers, where the agent confirms interest and consent before transferring

- Cold transfers, where the call is passed along with little or no context or verification

Call transfers can improve speed to contact and conversion rates, but without strong controls, they can expose call centers and buyers to compliance, brand, and financial risk. When done right, call transfers are a valuable part of a modernlead acquisition strategy.

But they also carry real risk. Let’s examine the most common risks associated with call transfers and the best practices for mitigating those risks.

Risks associated with call transfers

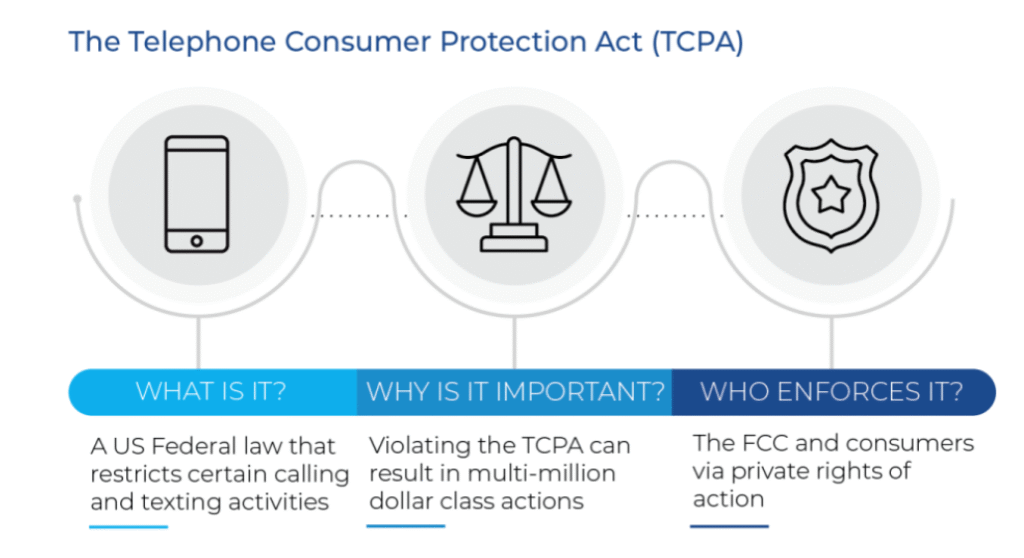

TCPA liability

The Telephone Consumer Protection Act (TCPA) has forced everyone remotely associated with the lead acquisition waters to tread carefully. Perhaps none more so than call centers that frequently employ the use of an Automatic Telephone Dialing System (ATDS).

Source: CompliancePoint

An ATDS allows companies to contact roughly 1,000 people every hour and if the proper measures are not taken with every call when using an ATDS, your company could be exposed to TCPA litigation.

A few examples of a TCPA violation include:

- Not obtaining prior express written consent before making contact

- Making contact with someone listed on the National Do-Not-Call Registry (DNC)

- Not treating texts the same as calls when using an ATDS

Stay up to date on all of the legal trends at TCPA World and don’t expose your business to hefty monetary losses. When in doubt, stick to the ABCs of TCPA: Always Be Compliant because the lead acquisition waters are treacherous, and the TCPA sharks are always circling.

Negative brand association

Call centers are often the first human interaction a consumer has with your brand. If that experience feels rushed, confusing, or intrusive, the damage can be immediate.

Cold or poorly executed transfers increase the risk of:

- Consumers feel misled about who they are speaking with

- Repetition of questions and frustration after transfer

- Perceived “bait-and-switch” tactics

Leads do not want to be pestered or have their time wasted. Leads are people. A well-trained call center staff –operating a cold or warm transfer strategy– needs to be polite, direct, engaging, and decisive.

Even a single bad transfer can undo years of trust-building, especially in regulated or high-consideration industries like insurance, financial services, and home services.

Targeted litigation risk

Litigators actively look for weak points in call transfer ecosystems. If a call center transfers unverified or non-compliant leads, it only takes one call to trigger broader exposure.

Once identified, litigators may:

- Stay on the line to identify the end buyer

- Request consent records immediately

- Expand claims across campaigns, vendors, and timeframes

According to data shared by our friends over at Anura, TCPA-related risks continue to rise:

- Penalties range from $500 to $1,500 per call or text

- TCPA claims have increased dramatically since 2020

- High-profile settlements regularly reach tens or hundreds of millions of dollars

Unverified call transfers don’t just risk a single fine. They can open the door to audits, reputational damage, and long-term legal costs.

Best practices for addressing risk

- Understand lead origination

Whether you buy leads or generate them yourself, understanding exactly how a lead was created is critical.

Lead buyers

Not all lead sellers operate with the same standards. Low-cost, high-volume leads often come with higher duplication rates, fraud risk, and weak consent language. Vet sellers carefully, ask for documentation, and confirm how consent is captured and stored.

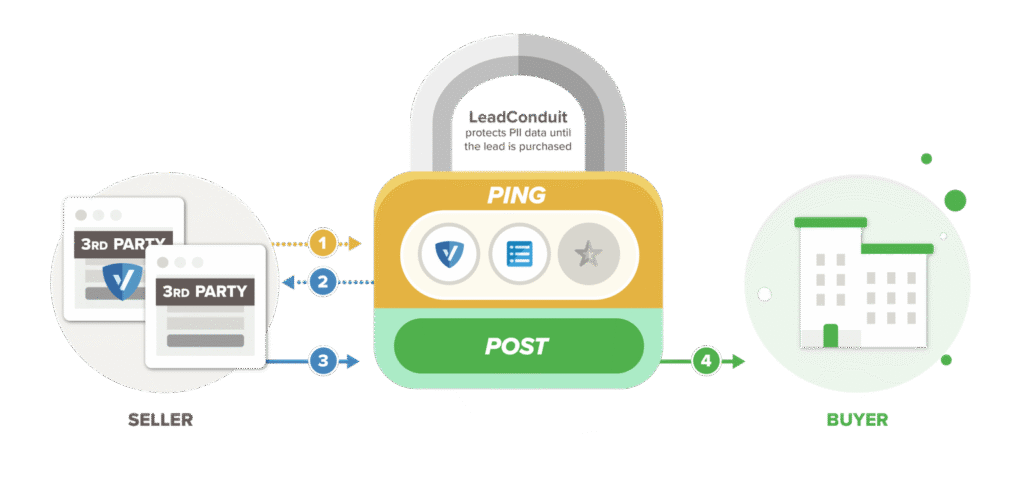

In a ping-post auction setting, you can leverage lead acquisition software to verify a lead’s credibility and viability before a purchase is made.

Lead generators

Whether you generate leads for your own use or to sell them to lead buyers, you must be equally careful. Compliance doesn’t stop at capture.

According to Attorney Michele Shuster from the MacMurray & Shuster law firm: “…it is important to implement TCPA compliance policies that include periodic lead audits, regular scrubs against state and federal DNC lists and company-specific DNC lists, and frequent TCPA and similar state laws compliance training.”

Automated lead optimization software like LeadConduit can help ease the burden on your lead acquisition and distribution efforts and help verify the quality and consent of your leads, and/or the credibility of your lead seller.

Understanding lead origination is important, but obtaining express written proof of consent will always be the most important first step in lead acquisition and distribution.

- Receive proof of consent with call transfer

Consent-based marketing is no longer optional. Prior express written consent must be obtained and retained before initiating calls or texts, especially when transfers are involved.

Proof of consent should include:

- The exact disclosure language shown to the consumer

- Timestamp and source of consent

- Consumer IP address and context

- Evidence that consent meets TCPA standards

TrustedForm provides independent, third-party proof of consent, capturing this data at the moment of lead submission. This gives both sellers and buyers confidence that transferred calls are backed by defensible records if challenged.

How to prevent cold transfers

Cold transfers increase risk because they move faster than verification. According to a study by the SQM Group, 19% of customers who contact a call center are transferred to another agent. The simplest way to reduce exposure is to reduce or eliminate cold transfers altogether.

Call centers can decrease cold transfer use by:

- Requiring agents to confirm interest and intent before transferring

- Verifying consent and key data points in real time

- Using pre-transfer validation rules that block incomplete or non-compliant leads

- Routing calls only after qualification thresholds are met

Platforms like LeadConduit help enforce these controls before a transfer happens. By validating data, checking compliance signals, and applying rules-based logic in real time, call centers will only transfer qualified, verified leads to buyers. This protects both parties and improves consumer experience at the same time.

Warm transfers may take slightly longer, but they consistently reduce complaints, improve conversion rates, and lower legal exposure.

Final thoughts

Risks associated with call transfers are inevitable, but the amount of risk is controllable with:

- TrustedForm: The highest standard for independent proof of consent and can protect you in the event of litigation while giving you new confidence that your leads have actually asked you to contact them.

- LeadConduit: Only accept leads that meet your criteria and prevent unverified leads from ever entering your CRM.

Mitigate your risk with the power of the ActiveProspect consent-based marketing platform today.