The future of Insurance: Using AI to drive growth and stay compliant

Artificial intelligence is transforming nearly every sector, and insurance is no exception. In ActiveProspect’s recent webinar, “How Insurance Carriers Use AI to Reach and Retain Consumers,” a panel of experts explored how Insurance carriers are leveraging AI to streamline operations, improve consumer engagement, and stay compliant in a complex regulatory environment.

The discussion featured Matt Fraser (GM of Insurance at ActiveProspect), Brandon Debenham (Sales Leader at Liberate), and John Henson (Founder at Henson Legal), moderated by Andrew Bailey from ActiveProspect. Together, they unpacked how AI is reshaping lead generation, compliance, and retention strategies—and what insurance carriers need to know to keep pace.

Key takeaways

Below are the main themes and takeaways from this insightful session:

- AI starts with easy wins – replacing outdated IVRs and streamlining claims intake.

- Biggest value = full integration – AI completing back-end tasks like payments or policy changes.

- Retention is a huge opportunity – faster service and personalization boost loyalty.

- Compliance is critical – AI voice counts as “artificial voice” under TCPA, so update consent and disclosures.

- Vet vendors carefully – check funding, data security, SOC 2/HIPAA/PCI compliance, and data usage policies.

- Outbound AI = higher risk – stricter rules, need clear scripts and off-ramps to humans.

- Train and monitor AI – treat it like a new employee, with testing and guardrails.

- Offer off-ramps – let consumers opt out or reach a human agent mid-interaction.

- Legacy systems are a hurdle – plan for latency and compatibility.

- Act now to stay ahead – early adopters will be better prepared as tech and regulations evolve.

Now let’s dive deeper into the topics presented above.

AI’s expanding role in Insurance carriers’ operations

One of the central themes was how AI is moving beyond hype to become a practical, revenue-driving tool for Insurance carriers. Brandon detailed how Liberate initially designed AI systems to handle claims intake, particularly during high-volume “catastrophe seasons” in Florida. At the height of hurricane season, the platform was filing one claim every six seconds—without human involvement.

However, the team soon discovered a broader application: Replacing outdated IVR systems with AI-driven voice interactions. By triaging inbound calls and routing them to the correct department in real time, carriers reduced wait times, improved service quality, and gained valuable insights into why customers were calling.

This shift shows how AI can start small—solving a straightforward operational pain point—and evolve into a strategic asset that enhances customer experience and organizational agility.

From IVR replacement to full integration

Panelists agreed that using AI to replace rigid IVR menus is an easy entry point for Insurance carriers. But the real long-term value comes from deep integrations with policy administration systems.

Brandon explained that the “magic” happens when AI systems can not only understand a customer’s intent but also complete back-end tasks—such as adding a vehicle to a policy or processing a payment—directly within carrier systems. This creates a seamless experience for the consumer and significant efficiencies for carriers.

Matt noted that while AI will not outperform a carrier’s top-performing human agents, it can level-set performance across teams, eliminate bottlenecks, and scale service capacity infinitely—especially critical during high-demand periods.

Compliance and risk mitigation: The non-negotiables

John, an attorney specializing in TCPA (Telephone Consumer Protection Act) and AI compliance, underscored the legal and regulatory risks of AI adoption. In early 2024, the Federal Communications Commission (FCC) clarified that AI-generated voice counts as “artificial voice” under the TCPA, placing it in the same regulated category as robocalls. This means AI-driven calls must meet strict consent, disclosure, and opt-out requirements.

Key compliance considerations discussed in the webinar included:

- Consent language: Traditional lead form disclosures covering autodialers are not sufficient for AI-generated voice. Consent language must explicitly mention AI or artificial voice technology.

- Required disclosures: AI-driven calls must include the caller’s identity, a callback number, and an opt-out mechanism within the first two seconds of pickup.

- Data security: Carriers should ensure their AI vendors adhere to standards such as SOC 2 Type II, HIPAA (if applicable), and PCI compliance for payment data.

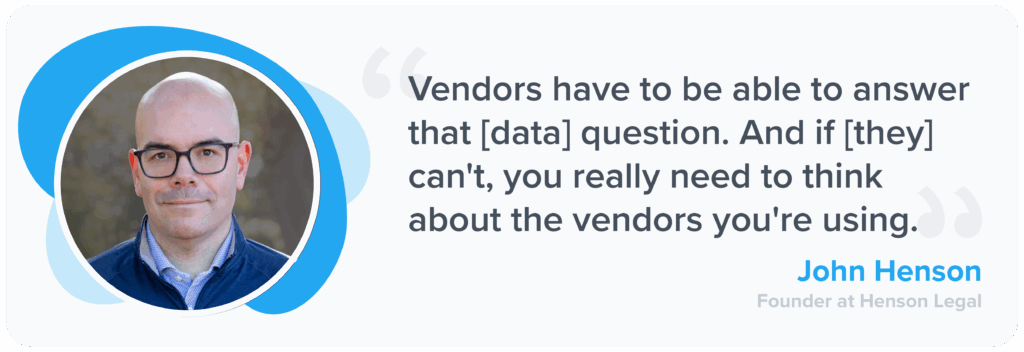

- Vendor risk: Carriers must vet AI providers carefully to avoid “fly-by-night” vendors who lack financial stability, compliance expertise, or secure data practices.

Vendor selection: Moving past the hype

All three panelists reflected on the explosion of AI products at industry conferences in the past year. While many were “pretty wrappers” around existing technologies, the market is now maturing. Carriers are moving toward specialized AI platforms with deep use-case expertise rather than generic solutions.

Practical tips for carriers evaluating AI vendors include:

- Assess financial stability: Ask about funding, staffing, and long-term plans to ensure the vendor will still be around in a year.

- Demand proof of compliance: Look for SOC 2 audits, HIPAA and PCI adherence, and single-tenant data storage.

- Understand the data lifecycle: Ask what data trained the model, what happens to your data after ingestion, and whether you retain access if the contract ends.

By treating vendor selection as a compliance and operational decision—not just a technology purchase—carriers can reduce risk while reaping AI’s benefits.

Outbound AI: The next frontier and its legal challenges

While inbound AI applications are relatively low-risk, outbound AI presents more regulatory hurdles. As John noted, the TCPA and Telemarketing Sales Rule (TSR) overlap but differ in key areas, creating gray zones for carriers.

For outbound campaigns, carriers must ensure:

- Explicit consumer consent for AI-generated calls.

- Scripts and disclosures that comply with TCPA/TSR requirements.

- Systems to recognize and honor revocations of consent—even when expressed in nonstandard language.

- Clear “off-ramps” to connect consumers with human agents upon request.

The panel also touched on emerging state-level laws and the importance of anticipating future regulatory shifts when designing AI strategies.

AI for retention: The unsung opportunity

While lead acquisition often dominates the conversation, the panel emphasized that retention is where AI can drive the biggest financial impact. By applying AI to service channels—claims, billing, policy updates—carriers can resolve requests faster, improve customer satisfaction, and ultimately boost retention.

Brandon highlighted how AI sentiment analysis can detect consumer frustration mid-call and automatically escalate to a human agent, preserving the customer relationship. This kind of proactive service turns AI from a cost-saver into a loyalty-builder.

Integrating AI with legacy systems

One recurring challenge is integrating AI tools with carriers’ older infrastructure. Many carrier APIs were built decades ago and may not support real-time response speeds required by AI. Panelists suggested that as carriers modernize their tech stacks, AI’s potential will expand dramatically.

This modernization trend extends beyond consumer-facing systems to distribution infrastructure, where carriers are replacing manual spreadsheets and legacy tools with platforms like Producerflow to automate producer licensing, appointments, and compliance tracking across their agent networks.

In the meantime, carriers adopting AI must plan for latency, data flow, and system compatibility. Strategic pilots and phased rollouts can help identify bottlenecks before full-scale deployment.

Pitfalls to avoid when implementing AI

The panel identified several common missteps that carriers should avoid:

- Using old consent language: Update disclosures to reflect AI-specific outreach.

- Underestimating training needs: Like a new employee, AI systems require time to be trained, tested, and optimized—expect a 60–120 day ramp-up.

- Ignoring consumer off-ramps: Ensure your AI can detect “stop” or “do not call” requests and seamlessly route to human agents.

- Treating AI as plug-and-play: AI is a strategic capability, not a magic switch. Success requires ongoing monitoring, iteration, and compliance reviews.

By addressing these pitfalls early, carriers can accelerate adoption while safeguarding their reputation and customer trust.

The bigger picture: AI’s evolution in Insurance

As the webinar wrapped up, each panelist shared a forward-looking takeaway.

The consensus was clear: AI in Insurance is at an inflection point. Carriers that adopt thoughtfully—balancing innovation with compliance—will gain a decisive edge in both customer acquisition and retention.

Final thoughts

ActiveProspect’s webinar underscored that AI is no longer a futuristic concept for Insurance carriers; it’s a present-day tool with measurable impact. From replacing outdated IVRs to enabling real-time claims processing, AI is reshaping how carriers engage consumers and manage operations.

Yet, success depends on more than just technology. Carriers must update consent language, vet vendors rigorously, and build guardrails to ensure compliance. Those that invest in the right infrastructure today will be positioned to offer faster, smarter, and more personalized service tomorrow.

As the panelists repeatedly emphasized, the industry is still in the early innings. But by embracing AI now—starting small, learning quickly, and scaling responsibly—insurance carriers can future-proof their business and set a new standard for customer engagement.

DISCLAIMER: This page and all related links are provided for general informational and educational purposes only and are not legal advice. ActiveProspect does not warrant or guarantee this information will provide you with legal protection or compliance. Please consult with your legal counsel for legal and compliance advice. You are responsible for using any ActiveProspect Services in a legally compliant manner pursuant to ActiveProspect’s Terms of Service. Any quotes contained herein belong to the person(s) quoted and do not necessarily represent the views and/or opinions of ActiveProspect.